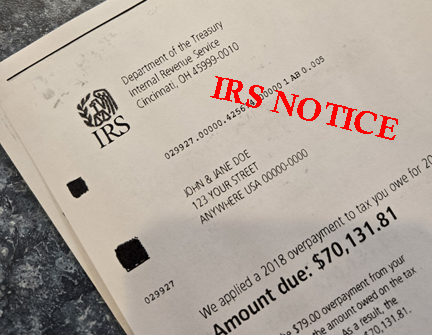

HERE COME THE NOTICES!

The IRS is Back in the Collection Business

After a hiatus of over two years in mailing automated collection notices to delinquent citizens, the IRS is firing up the collection machine once again. This means that millions of citizens will soon begin receiving a barrage of tax-due notices and payment demands from the agency.

On August 21, 2020, during the height of the pandemic, the IRS announced that it was suspending the mailing of three specific collection notices: CP501, CP503 and CP504. These are follow-up notices mailed to citizens who owe taxes but have not paid in response to the initial tax-due notice, CP14.

The three suspended notices use progressively stiffer and more threatening language in communicating the nature of the delinquent debt and the need to pay right away. The CP504 threatens to levy a state tax refund owed to a taxpayer if the federal tax is not paid in full by the deadline expressed in the letter. For a full discussion of the IRS’s collection process and how to respond to notices, see chapter 4 of my book, How to Get Tax Amnesty.

The IRS suspended the mailing of these notices because of the agency shutdown that occurred in 2020. The result of the shutdown was the agency very quickly became overwhelmed with a backlog of millions of pieces of incoming correspondence. The IRS had shipping containers stuffed full of more than 30 million unopened envelopes containing tax returns, checks, and letters in response to various IRS correspondence. The IRS stopped the mailing of the three notices mentioned above until it could reduce the backlog.

In February 2022, with the backlog not improving, the IRS announced that it was suspending the mailing of more than a dozen additional enforcement letters, applicable to both individuals and businesses. The IRS pointed out that it was still facing millions of unprocessed tax returns and was “taking this step to help avoid confusion for taxpayers and tax professionals.” By the end of the 2021 filing season, the IRS faced a backlog of more than 35 million tax returns. The IRS was dealing with what it called “unprecedented demands” on its systems brought about by the pandemic.

And while the agency still has a backlog of unprocessed documents, National Taxpayer Advocate Erin Collins reported in December 2023 that by the end of 2022, “The IRS had worked through most of its processing backlog” of tax returns.

That’s the good news.

The bad news is, now that the agency has worked through the lion’s share of the processing backlog, it announced in December that it is “resuming normal collection notices” beginning in 2024. As an apparent courtesy to taxpayers who haven’t seen a notice in some time, the IRS will start with a “special reminder letter.” The letter is intended to “alert the taxpayer of their liability,” as well as recommend “easy ways to pay” the tax. This will put the delinquent citizen on notice that the IRS is back in the collection business.

The IRS also announced that it will grant certain automatic penalty relief to those who owed taxes during the period the notice machine was turned off. The announcement declares that the IRS will automatically cancel the failure to pay penalty for taxes owed during 2020 or 2021. The relief applies to any taxpayer who, as of December 7, 2023, owes less than $100,000 for tax year 2020 or 2021, and who was issued an initial balance due notice (CP14) on or before December 7, 2023, for the year 2020 or 2021. The relief applies to 1040 tax return filers and most corporate taxpayers filing Form 1120 or 1120S. About 4.7 million individuals, businesses, and tax-exempt organizations will be eligible for penalty relief for tax years 2020 and 2021. But the relief is temporary. If the tax owed is not paid right away, the penalty will resume accruing on April 1, 2024.

With the IRS now back in the collection business, anyone with a delinquent tax debt simply must pay attention to IRS correspondence. The string of collection notices – CP501, CP503 and CP504 – makes it clear that the IRS intends to enforce collection if payment is not made by the stated deadline, or if arrangements are not made to pay over time. But, the IRS cannot take actual enforcement action until it mails a Final Notice, Notice of Intent to Levy and Notice of Your Right to a Hearing (LT11 or Letter 1058), per Code sections 6330(a) and 6331(d).

These are the last in the series of collection letters. They communicate the fact that the string is out, and the IRS is about to take enforcement action, such as wage or bank levies. The letters provide that the tax must be paid in full within thirty days, or the IRS will take levy action.

The letters also provide notice of your right to a Collection Due Process (CDP) hearing, which is a hearing before the IRS’s Office of Appeals. See: Code § 6330. A CPD hearing gives the taxpayer the opportunity to present an alternative to enforcement action under which the tax is paid in a manner that does not cause hardship. But if you don’t respond within the thirty-day deadline, you lose your right to a CPD hearing.

If you have unpaid tax debt, don’t wait to seek a resolution. Consult competent, experienced counsel who can guide you through the maze of settlement options that are available. Start by reading my book, How to Get Tax Amnesty.

More on the Decision to Grant Relief of the Failure to Pay Penalty

While it is magnanimous of the IRS to grant relief to taxpayers of failure to pay penalties that accrued during the two-year period the agency shutdown the mailing of collection notices, I believe it did the right thing for the wrong reason. As we know from the above article, the IRS granted automatic (albeit temporary) relief from the failure to pay penalty that accrued during the period the mailing of notices was shutdown.

I am all in favor of the IRS granting penalty relief – and for just about any reason. However, I find it odd that it would use the “we weren’t sending notices” argument to justify the decision. I say that based on Internal Revenue Code section 7524. That section was added to the law by the IRS Restructuring and Reform Act of 1998. That statute requires the IRS to send taxpayers with delinquent accounts a written notice that sets forth the amount of the tax owed as of the date of the notice, and to do so “[n]ot less often than annually.”

IRS meets this legal obligation by sending Notice CP71. Even taxpayers whose accounts have been closed as Currently Not Collectible due to hardship, or who are on a formal installment agreement, receive Notice CP71 annually. It’s important to note that the CP71 was not among the many notices that were suspended pursuant to the IRS announcements mentioned above. See: IRS Notice IR-2022-31, February 9, 2020. Thus, even though delinquent taxpayers did not receive collection notices during the shutdown period, they did in fact continue to receive their annual reminder notices, as required by Code section 7524.

Now you might say, “Hey Dan, why nitpick? What’s the difference why the IRS cancels the penalty, as long as they do?”

I’m not one to look a gift horse in the mouth. However, in this case, I believe the gift is coming from the other end of the horse. I say that because the IRS should be granting hardship relief, not administrative relief because it stopped sending certain collection notices. Even with collection notices having stopped, taxpayers did continue to receive CP71 notices.

The problem is not that they didn’t know, or somehow forgot, that they owed taxes. The problem is that they couldn’t pay due to the economic hardship created by government shutdown orders halting commercial trade, commerce and interaction practically nationwide.

Recall that in August 2022, the IRS announced that it was granting automatic relief from the failure to file penalties for tax years 2019 and 2020, if delinquent returns were filed by September 30, 2022. See: IR-2022-155, August 24, 2022; IRS Notice 2022-36.

The overarching reason for that penalty relief is the fact that a nationwide emergency declaration was issued by the president, effective March 13, 2020. That declaration was issued as a result of the ongoing COVID-19 pandemic. The declaration instructed, among other things, the Treasury Secretary “to provide relief from tax deadlines to Americans who have been adversely affected by the COVID-19 emergency…” As part of the response, the IRS extended certain return filing deadlines in 2020 and 2021.

Most people with tax compliance problems attributable to COVID issues were not unable to file returns on time. Most people couldn’t pay because of the negative economic impact of the shutdown orders. Why did the IRS grant relief from the filing penalties but not relief from the payment penalties, when clearly, the lack of ability to pay was the issue driving most delinquency problems?

Interestingly, some of the reasoning expressed in Notice 2022-36 for granting filing relief had to do with the IRS facing what turned out to be an overwhelming backlog of unprocessed returns. Agency employees were spread thin attending to other aspects of pandemic relief legislation passed by Congress (such as distributing economic impact payments to millions of people), while at the same time, attempting to recover from its own operations shutdown.

So while the IRS recognized that “Americans adversely affected” by COVID needed and deserved relief from failure to file penalties, no mention was made of the failure to pay penalty. Not until January 2024 did it occur to IRS thinkers in Washington that people needed help on that front also. But, rather than raise the hardship issue, the IRS proffers that relief is needed because, somehow, people may have forgotten that they owe taxes (never mind the CP71 reminders).

Clearly, recognizing broad-based economic hardship factors would expand potential relief to taxpayers who do not fall into the narrow time and liability restrictions mentioned in the January 2024 notice. For example, I recently spoke with a construction business owner from southern California who owes about $600,000 in employment taxes for 2022 and 2023. The liabilities stem largely from problems caused by COVID shutdown orders. He is not subject to the automatic penalty relief because he owes more than $100,000. Yet, his problems fall directly into the class of economic hardship issues that the IRS knows full well exist in droves throughout the nation.

So while it is good news that the IRS is granting failure to pay penalty relief, the program does not go nearly far enough to address the problems created in the economy by the government shutdown orders we suffered through in 2020 and 2021.

If you are facing such penalties, you must read chapter 4 of my book, The IRS Problem Solver. There I address the strategies for winning cancelation of penalties based on reasonable cause. See also: chapter 17, Dan Pilla’s Small Business Tax Guide.

Want to read the other articles in this issue? Order Pilla Talks Taxes

PTT subscribers get this article and more when they download their February 2024 issue of Pilla Talks Taxes. Looking for a single issue? Contact our office for pricing.

Looking for a tax pro in your area? Check out our Taxpayers Defense Institute consulting members.

February

Pilla Talks Taxes

HERE COME THE NOTICES!

The IRS is Back in the Collection Business

IRS TO BEGIN REDESIGNING NOTICES

Agency Launches “Simple Notice Initiative”

IRS PREPARES TO INSTITUTE DIGITAL CURRENCY REPORTING RULES

Agency Drafting Regulations

CLAIM FOR REFUND STATUTE OF LIMITATIONS

Understanding the “Financial Disability” Exception

By Scott MacPherson, Attorney at Law

————————–

January

SPECIAL REPORT

THE CORPORATE TRANSPARENCY ACT

Beneficial Ownership Information Reporting Requirements

————————-

December

SPECIAL REPORT

HOW TO RELEASE WAGE AND BANK LEVIES

A Deep Dive into the Idea of “Economic Hardship”

LOOKING TO STAY CURRENT ON THE LATEST TAX CHANGES?

Dan Pilla' monthly newsletter, Pilla Talks Taxes, features news stories and developments in federal taxes that effect your pocket book. Each information packed issue shows you how to use little known strategies to cut your taxes, protect yourself from the IRS, exercise important taxpayers' rights and keeps you up to date on the latest trends in Washington on the important subjects of taxes and your rights. You can't afford to miss a single issue!

10 issues per year. $99.00 per yr Order Now!

Click here for more information on

PTT articles and subscription options.

An email address is required to receive this newsletter.

--------------------------

LOOKING FOR A SPECIFIC TOPIC?

Check out our

INDEX of PILLA TALKS TAXES articles