Strategies to Cut Taxes and Avoid Hassle

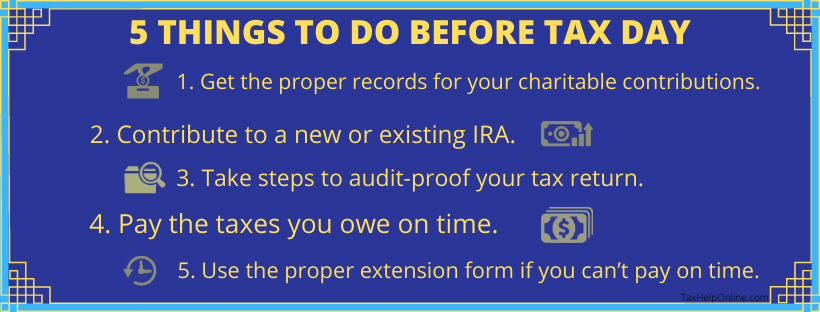

To help reduce the pain of tax filing season, I’ve marshaled a list of five critical things to keep in mind as the day of reckoning bears down. Let’s just go down the list.

- Get the proper records for your charitable contributions.

Every year people get blindsided by a little-known recordkeeping requirement for charitable contributions. This hitch could cost you thousands of dollars in lost deductions if you don’t have the proper paperwork. What you need is simple but often overlooked.

The law requires that you have a “contemporaneous acknowledgment” of your contributions in hand before the due date of the return claiming the contributions. The acknowledgment must be in writing and must come from the charitable organization to which you gave money. The acknowledgement must state:

- The amount of your gift,

- The date of the gift and most importantly,

- Whether you received anything of value in return for your gift. If so, the value of the item received must be listed in the statement.

If nothing was received in exchange for the gift, the statement must show that you received only an “intangible religious benefit.”

This rule applies to one-time contributions in excess of $250 to any one organization. It DOES NOT apply to the total of contributions made over the year. The idea behind the law is that you cannot claim a deduction for the value of any tangible benefit you receive in exchange for a gift.

For example, suppose you contribute $250 to your church and in exchange, you get four $25 tickets to the annual benefit dinner. You gave $250 but got back tangible benefits worth $100. In that case, you can only deduct $150 (250 – 100 = 150), not the entire $250 gift.

The real key to this rule—and where many people get tripped up—is that the acknowledgment must be in hand before the due date of your tax return. It is NOT good enough to obtain an acknowledgement later. Even if you show canceled checks to prove every nickel of your deduction and even if you manage to come up with an after-the-fact acknowledgment, your deduction will be disallowed if the acknowledgement does not predate the return’s due date.

- Contribute to a new or existing IRA.

You have until April 15 to contribute to a new or existing IRA.

If you contribute before April 15, you can designate it to the prior’s year tax return. This way, you still have the opportunity to lower last year’s taxes even though last year is long gone.

This is significant for those facing a bill this April 15 because the contribution can cut your taxes substantially. For example, single persons and those married filing separate returns can contribute up to $6,000 to a traditional IRA (there is no deduction for Roth IRA contributions) and get a deduction for the contribution. The contribution cap is $7,000 for persons are 50 years of age or older). In the case of married filing jointly, each spouse can contribute up to $6,000, for a total of $12,000 (or $7,000 each if both are 50 or older). Now look what happens when you balance the tax deduction for the contribution against a looming tax debt.

Suppose you’re married filing jointly. Suppose further your combined federal and state effective tax rate is 35 percent. If you contribute the maximum of $12,000, this move saves you $4,200 in taxes

To determine exactly how this strategy might benefit you, just take your combined federal and state tax rates (I used 35 percent as an example) and multiply that percentage by the amount of your contribution. In my example: $12,000 x .35 = $4,200. The product ($4,200 in my example) is the amount of tax reduction realized.

The best part of it is while you have to cough up cash to make the deal, the money is still your money. Unlike paying taxes, your IRA money is not down the tubes (assuming it’s invested correctly!).

- Take steps to audit-proof your tax return.

For years, I’ve recommended that people audit-proof their tax returns. This is even more important now as the IRS’s audit machine moves into high gear. A critical step in the audit-proofing process is to use affidavits to prove what I call the “intangible elements” of certain deductions.

An affidavit is nothing more than a detailed letter of explanation that you have notarized. It sets forth specific facts relative to a situation. The facts form the foundation of proof necessary to sustain a deduction. An affidavit is critical when a deduction requires proof of something for which there is no paperwork. Let me give you some common examples.

- Home office – The home office deduction requires proof of two issues that can only be proved with an affidavit. The first is the “regular and exclusive use” test. To claim a home office deduction, you must use the space in your home “regularly and exclusively” for business purposes. Next, you must show either, a) that tasks most important to the success of your business are performed there and there is no other location available to you do perform such tasks, or b) that you meet regularly with customers, clients or patients in your home office. Because of the nature of these facts, you’ll never have a receipt or canceled check to prove them. Only your testimony can prove them. Dan Pilla’s Small Business Tax Guide has more discussion on this issue.

- Business miles – To be deductible, the miles you travel in your auto must be related to business. You should keep a mileage log describing the date and distance of your travel, the name of the person visited and the business purpose of the trip. There is never a receipt showing the business purpose for your meeting. Your testimony through an affidavit is the only way to fill this gap. See Dan Pilla’s Small Business Tax Guide for more details on this process.

- Non-cash charitable contributions – For all non-cash charitable contributions, you must prove the fair market value of the item contributed. Your deduction is based on the item’s fair market value at the time of the gift. Many people give children’s clothing, toys, used furniture, etc. Because it is virtually impossible to obtain a reliable appraisal of such items, the only way to prove fair market value is through an affidavit. Your affidavit must show a description of the item, its original price, its current condition, replacement cost, etc., and your reasonable estimate of fair market value.

By having your affidavits notarized before filing your return, you fix in time the fact that these contributions occurred during the year you claimed them. This gives you an airtight document package to prove your deductions if challenged later. For more details on creating affidavits and the audit-proofing process in general, please see my books, How to Win Your Tax Audit and The IRS Problem Solver.

- Pay the taxes you owe on time.

While this might seem simple, many people fall into a hidden trap. Each year, millions of citizens who cannot pay on time file Form 4868, Automatic Extension of Time to File Form 1040. That form gives you six additional months to file your tax return. However, it does not apply to the payment of taxes.

Even though Form 4868 pushes your filing deadline to October 15, you still have to pay what you owe by April 15. If you do not pay by April 15, the IRS will charge the late payment penalty and interest, regardless of the filing extension. That penalty can be up to 25 percent of the delinquent tax, plus the IRS will charge interest on both the tax and penalty.

If you can’t pay the tax on time, don’t use Form 4868. However, the next section of this article will help you.

- Use the proper extension form if you can’t pay on time.

If you can’t pay on time, there are two alternatives to help you. Use either or both, depending on your situation. In any event, file your tax return on time to avoid the additional failure to file penalty.

- IRS Form 1127– This is one of the IRS’s best-kept secrets. It is the Application for Extension of Time Pay Income Taxes. This is not a filing extension. It is a payment extension. However, it is not automatic. To get it approved, you must show that you took reasonably prudent steps to provide for the payment of your taxes but because of circumstances beyond your control, you cannot pay on time. Once approved, you can get up to six additional months to pay the tax—without penalties (but interest on the unpaid tax continues).

- IRS Form 9465– This form is the monthly installment agreement request. Use it if you cannot pay what you owe within six months. The form asks for the monthly installment payment you propose. This process is not automatic either. However, if you: a) owe less than $50,000, b) can pay the bill in full within 72 months, and c) had no prior installment agreements, you qualify for the streamlined installment agreement rules. This means the IRS accepts just about any terms that will full pay within 72 months. For more details on this process, please see chapter 5 of my book, How to Get Tax Amnesty. If you any substantial amount to the IRS, you must review the Offer in Compromise program I discuss in chapter 12 of How to Get Tax Amnesty.

LOOKING TO STAY CURRENT ON THE LATEST TAX CHANGES?

Dan Pilla’ monthly newsletter, Pilla Talks Taxes, features news stories and developments in federal taxes that effect your pocket book. Each information packed issue shows you how to use little known strategies to cut your taxes, protect yourself from the IRS, exercise important taxpayers’ rights and keeps you up to date on the latest trends in Washington on the important subjects of taxes and your rights. You can’t afford to miss a single issue!

10 issues per year. $99.00 per yr Order Now!

An email address is required to receive this newsletter.