by Daniel Pilla | Dec 8, 2022 | Urgent deadlines

END OF YEAR TAX PLANNING Nine Simple Steps that Can Cut Taxes and Pain With the end of the year fast approaching, you’re probably wondering what you can do to cut your taxes. Remember: if you wait until April to start thinking about this, it’s just too late. Here are...

by Daniel Pilla | Nov 21, 2022 | PTT Featured Article

CRYPTO CASES TO TOP CI’S “TO-DO LIST” IN 2023You Can’t Hide Crypto Assets The Internal Revenue Service’s (IRS) Criminal Investigation (CI) function is charged with investigating allegations of criminal tax fraud, and assisting the Department of Justice (DOJ) and the...

by Daniel Pilla | Sep 2, 2022 | PTT Featured Article

THE BIDEN ADMINISTRATION DOESN’T KNOW WHAT A TAX CHEAT IS Deliberate Deception Inflames Greed and Envy In his letter to the U.S. Senate (see above), Commissioner Rettig did his part to carry water for the Biden Administration’s push for $80 billion in new funding to...

by Daniel Pilla | Jul 22, 2022 | PTT Featured Article

(WE FILED!) COMPLAINT REGARDING IRS EMPLOYEE MISCONDUCT Taxpayers Defense Institute Steps Up to Protect Your Right to Counsel In the June 2022 issue of PTT, we reported on the outrageous statements made by the IRS and Commissioner Rettig regarding your...

by Daniel Pilla | Jun 29, 2022 | PTT Featured Article

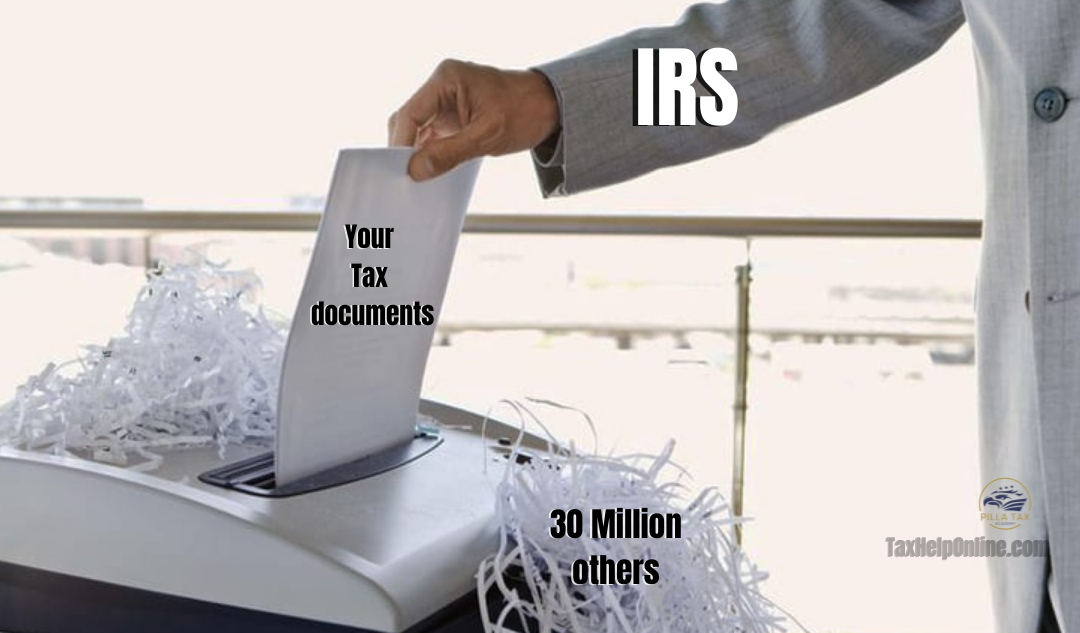

SURVIVING THE “GREAT SHRED” OF 2022 How to Keep From Being Victimized by IRS Housecleaning The lead article in last month’s Pilla Talks Taxes reported that the IRS destroyed 30 million tax documents. That article was also published by National Review and...