QUICK SOLUTIONS

TO THE MOST COMMON TAX PROBLEMS

Forgiveness of Tax Debt – How To Be Forgiven of Tax Debt You Cannot Pay

The vast majority of people who owe taxes are honest people in financial trouble through no fault of their own. They need help. They need a way to solve the problem. Continued levies and seizures don’t solve the problem. It just drives people underground. When you force people to make a choice between paying taxes and feeding their family, they will feed the family every time.

Perhaps the IRS’s best-kept secret is that you can be forgiven of tax debt you owe but cannot pay. When on the threshold of establishing new IRS programs, then IRS Commissioner, Shirley Peterson stated that “you can’t get blood from a turnip, and when we’re dealing with turnips, we’re better off cutting our losses and moving on.” She realized that by offering a reasonable forgiveness program, people are brought back into the system as productive, taxpaying citizens. This is far more desirable than hiding in the underground economy or living on government assistance.

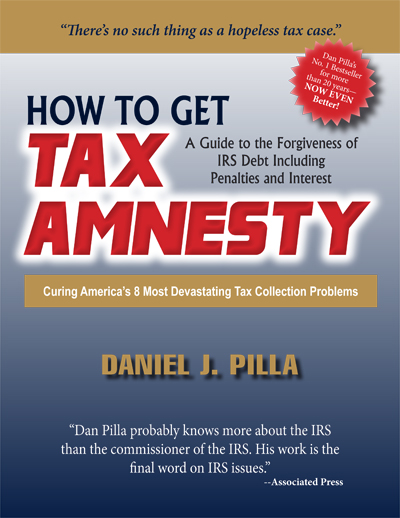

Below are the four programs of tax debt forgiveness discussed in Dan Pilla’s book How to Get Tax Amnesty.

PROGRAM ONE – “The Life Jacket”

If you owe taxes but are either unemployed or underemployed and cannot make a payment, you can request what is referred to as “uncollectible status.” This is the process the IRS uses to freeze the collection account. The agency ceases any attempts to enforce collection in order to give you time to get back on your feet financially.

While it is not a permanent fix to your tax problem, it does help greatly by stopping wage levies, bank levies and property seizures. To obtain uncollectible status, you need to file a financial statement on Form 433A for individuals, and Form 433B for businesses. The financial statement shows the IRS that all the money you earn is needed to provide necessary living expenses for your family. Uncollectible status helps you to stay afloat until you are able to pay the tax or apply for forgiveness under another program.

PROGRAM TWO – “Cents on the Dollar”

Using the Offer In Compromise program, we have settled countless cases for less than 10 cents on the dollar. The IRS’s Offer in Compromise was revised in 1992 because of my book How Anyone Can Negotiate With The IRS and WIN! That was the first book ever written for the public that exposed the right to discharge taxes in bankruptcy.

Under the Offer in Compromise program, you settle your case for less than you owe. The settlement amount is determined on the basis of what you can afford to pay. For example, suppose you owe $50,000 but you can afford to pay just $10,000. In that case, you’d settle for 20 cents on the dollar.

This process has saved taxpayers literally billions of dollars in taxes, penalties and interest they could never otherwise have paid. This allows them to get back on tract as productive, taxpaying citizens free of IRS enforcement and the nagging presence of IRS liens.

There are three different Offer in Compromise programs:

The most common is based upon your ability to pay. It’s called an offer based upon doubt as to collectability. Under that program, you settle for what you are able to pay, rather than what you owe.

Under the second program, you’re able to challenge the amount of the actual debt and settle for what you actually owe, not what the IRS says you owe. This is called an offer based upon doubt as to liability. This is especially helpful for victims of a bogus tax audit.

The third program allows you to pay a lesser amount if full payment of the tax would put you into a position of financial hardship in the future. This is called an effective tax administration offer. This is very helpful in cases where you have sufficient equity in your house to pay the tax, but full payment would wipe out all your resources and make if difficult or impossible to provide for future living expenses.

PROGRAM THREE – “Wage-Earner’s Repayment Plan”

Contrary to what many tax professionals believe, income taxes are dischargeable in bankruptcy! This right has existed since 1966. However, it was not until 1989, on the heels of the release of Dan’s book How Anyone Can Negotiate With The IRS and WIN!, that this fact was made known to the public on a broad scale. Because of that, the IRS was forced to rewrite its Publication 904, dealing with the issue of discharging taxes in bankruptcy. The publication was rewritten to reflect your ability to discharge taxes in bankruptcy.

A Chapter 13 bankruptcy allows a taxpayer to enter into an agreement to pay back taxes in accordance with his ability to make monthly payments. When certain rules are met, whatever cannot be paid back within 60 months is usually discharged.

Because the IRS has revised its Offer in Compromise procedures, thousands of these bankruptcies have been avoided. However, knowing your right to a Chapter 13 discharge is mandatory. In many cases you must let the IRS know of your ability to discharge taxes in order for them to give serious consideration to your offer. You must be prepared to show the IRS that they will get more by accepting your offer than they will by forcing you into bankruptcy.

PROGRAM FOUR – “Fresh Start”

This program requires the filing of a Chapter 7 bankruptcy. Under a Chapter 7, certain taxes can be discharged entirely and a fresh start granted. For some, this is the best and fastest way to eliminate tax debt entirely and creating a new life free from IRS liens and levies. When properly filed, the IRS must cancel your debt and allow you to start over.

Understanding your right to a fresh start through a Chapter 7 may prevent you from having to file one. For example, you may be able to first obtain uncollectible status and survive on that status long enough to be able to make an Offer in Compromise. The fact that you could file a Chapter 7 can provide the IRS with just the right motivation to allow you a little more time to get on your feet. While bankruptcy is often the last choice to resolve a tax debt, just knowing this right can prevent you from ever having to use it.

Solutions - Book Packages

Package 1

IRS Abuse Prevention Package $59

Includes:

- Small Business Tax Guide

- How to Win Your Tax Audit

Package 2

Tax Problem Resolution Package $75

3 Best Sellers

Includes:

- How to Get Tax Amnesty

- The IRS Problem Solver

- How to Win Your Tax Audit

IRS Defense Library $249

Includes:

- All of Dan's Current Books

- One year of Pilla Talks Taxes

Dan's electronic newsletter

Back to Quick Solutions Packages Back to Top

Packages qualify for one free 15 minute phone consult with Dan...$99 value