by Daniel Pilla | Mar 3, 2026 | PTT Featured Article

19 THINGS TO KEEP IN MIND FOR 2025 TAX FILINGS Tax Law Changes Continue to Muddy the Waters The One Big Beautiful Bill Act changed a significant number of rules and benefits for 2025 individual tax returns (and beyond). Consider these 19 critical points when preparing...

by Daniel Pilla | Feb 23, 2026 | PTT Featured Article

TARIFF DIVIDEND CHECKS? REALLY? Don’t Spend the Money Just Yet If I were you, I wouldn’t make any plans to spend the $2,000 tariff “dividend” rebates President Trump proposed for low- and middle-income taxpayers. The idea apparently is to offset the higher costs of...

by Daniel Pilla | Nov 4, 2025 | PTT Featured Article

THE IRS AND THE GOVERNMENT SHUTDOWN What May be in Store for Taxpayers The ongoing government shutdown illustrates just how deeply flawed our current tax system truly is. As of October 8, the IRS furloughed nearly half its staff, leaving taxpayers and practitioners...

by Daniel Pilla | Aug 27, 2025 | PTT Featured Article

THE TREATMENT OF GAMBLING LOSSES UNDER THE OBBBAGamblers Face Tax Liabilities on Phantom Income Under Code section 61, gambling income is fully taxable. It has been forever. Code section 165(d) controls the extent to which gambling losses are deductible. The law...

by Daniel Pilla | Aug 18, 2025 | PTT Featured Article

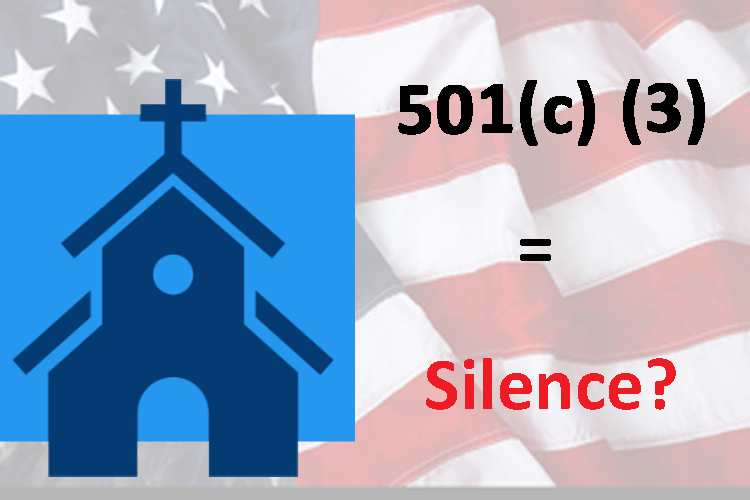

THE NEFARIOUS JOHNSON AMENDMENT How the Government Bought the Silence of the Church in America There’s a provision of the Internal Revenue Code that has effectively bought the silence of the church in America. By that we mean that the law in question is responsible...

by Daniel Pilla | Jul 1, 2025 | PTT Featured Article

CURRENT STATUS OF IRS FORCE REDUCTIONS Are IRS Functions Now Crippled? Since President Trump began down-sizing federal agencies in earnest in March, the IRS has lost about 18,000 workers. These include both individuals taking the offer of early retirement, and the...